Porter’s 5 Forces

What is it about?

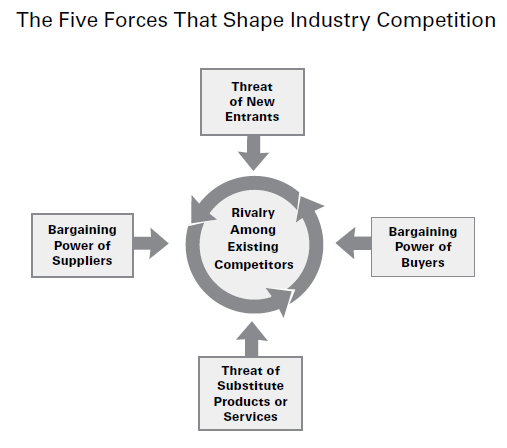

After coming up with a business idea, filling out the business model canvas and developing the company’s mission, there is still a missing piece which needs to be adressed to sustain long-term business success: you must reflect upon and strategically respond to your competition. Naturally, one thinks of established rivals and direct competitors, however four additional forces can hurt prospective profits:

- Savvy customers can force down prices by playing you and your rivals against one another.

- Powerful suppliers may constrain your profits if they charge higher prices.

- Aspiring entrants, armed with new capacity and hungry for market share, can ratchet up the investment required for you to stay in the game.

- Substitute offerings can lure customers away.

Consider commercial aviation: It’s one of the least profitable industries because all five forces are strong. Established rivals compete intensely on price. Customers are always searching for the best deal regardless of carrier. Suppliers—plane and engine manufacturers, along with unionized labor forces—bargain away the lion’s share of airlines’ profits. New players enter the industry in a constant stream. And substitutes are readily available—such as train or car travel.

By analyzing all five competitive forces, you gain a complete picture of what’s influencing profitability in your industry. You identify game-changing trends early, so you can swiftly exploit them. And you spot ways to work around constraints on profitability—or even reshape the forces in your favor.

Through understanding how the five competitive forces influence profitability in your industry, you can develop a strategy for enhancing your company’s long-term profits. Porter suggests the following:

POSITION YOUR COMPANY WHERE THE FORCES ARE WEAKEST:

Example:

In the heavy-truck industry, many buyers operate large fleets and are highly motivated to drive down truck prices. Trucks are built to regulated standards and offer similar features, so price competition is stiff; unions exercise considerable supplier power; and buyers can use substitutes such as cargo delivery by rail.

To create and sustain long-term profitability within this industry, heavy-truck maker Paccar chose to focus on one customer group where competitive forces are weakest: individual drivers who own their trucks and contract directly with suppliers. These operators have limited clout as buyers and are less price sensitive because of their emotional ties to and economic dependence on their own trucks.

For these customers, Paccar has developed such features as luxurious sleeper cabins, plush leather seats, and sleek exterior styling. Buyers can select from thousands of options to put their personal signature on these built-to-order trucks.

Customers pay Paccar a 10% premium, and the company has been profitable for 68 straight years and earned a long-run return on equity above 20%.

EXPLOIT CHANGES IN THE FORCES

Example:

With the advent of the Internet and digital distribution of music, unauthorized downloading created an illegal but potent substitute for record companies’ services. The record companies tried to develop technical platforms for digital distribution themselves, but major labels didn’t want to sell their music through a platform owned by a rival.

Into this vacuum stepped Apple, with its iTunes music store supporting its iPod music player. The birth of this powerful new gatekeeper has whittled down the number of major labels from six in 1997 to four today.

RESHAPE THE FORCES IN YOUR FAVOR

Use tactics designed specifically to reduce the share of profits leaking to other players.

For example:

- To neutralize supplier power, standardize specifications for parts so your company can switch more easily among vendors.

- To counter customer power , expand your services so it’s harder for customers to leave you for a rival.

- To temper price wars initiated by established rivals, invest more heavily in products that differ significantly from competitors’ offerings.

- To scare off new entrants, elevate the fixed costs of competing; for instance, by escalating your R&D expenditures.

- To limit the threat of substitutes, offer better value through wider product accessibility. Soft-drink producers did this by introducing vending machines and convenience store channels, which dramatically improved the availability of soft drinks relative to other beverages.

Think about how the 5 forces influence your own business and what you can do to exploit or reshape them, or what you can do to position your business beneficially to gain a competetive advantage.

As always we hope that this post was helpful! Please leave a like and let us know in the comments what you think about this model!

NOTE: This model was not created by us. It was developed by Michael E. Porter and refurbished in the Harvard Business Review. To read the full article via: https://hbr.org/2008/01/the-five-competitive-forces-that-shape-strategy

For additional information, use the free access to our community to check out our exclusive online classes!

© 2022 establi

All information is without guarantee.